Average Property Tax In Louisville Ky . Property taxes in in kentucky are relatively low. The typical homeowner in kentucky pays just $1,382 annually in property. louisville, kentucky stacks up well in nearly any property tax rate comparison. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. The real estate tax rate. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. Yearly median tax in jefferson county. The median property tax in jefferson county, kentucky is $1,318. overview of kentucky taxes.

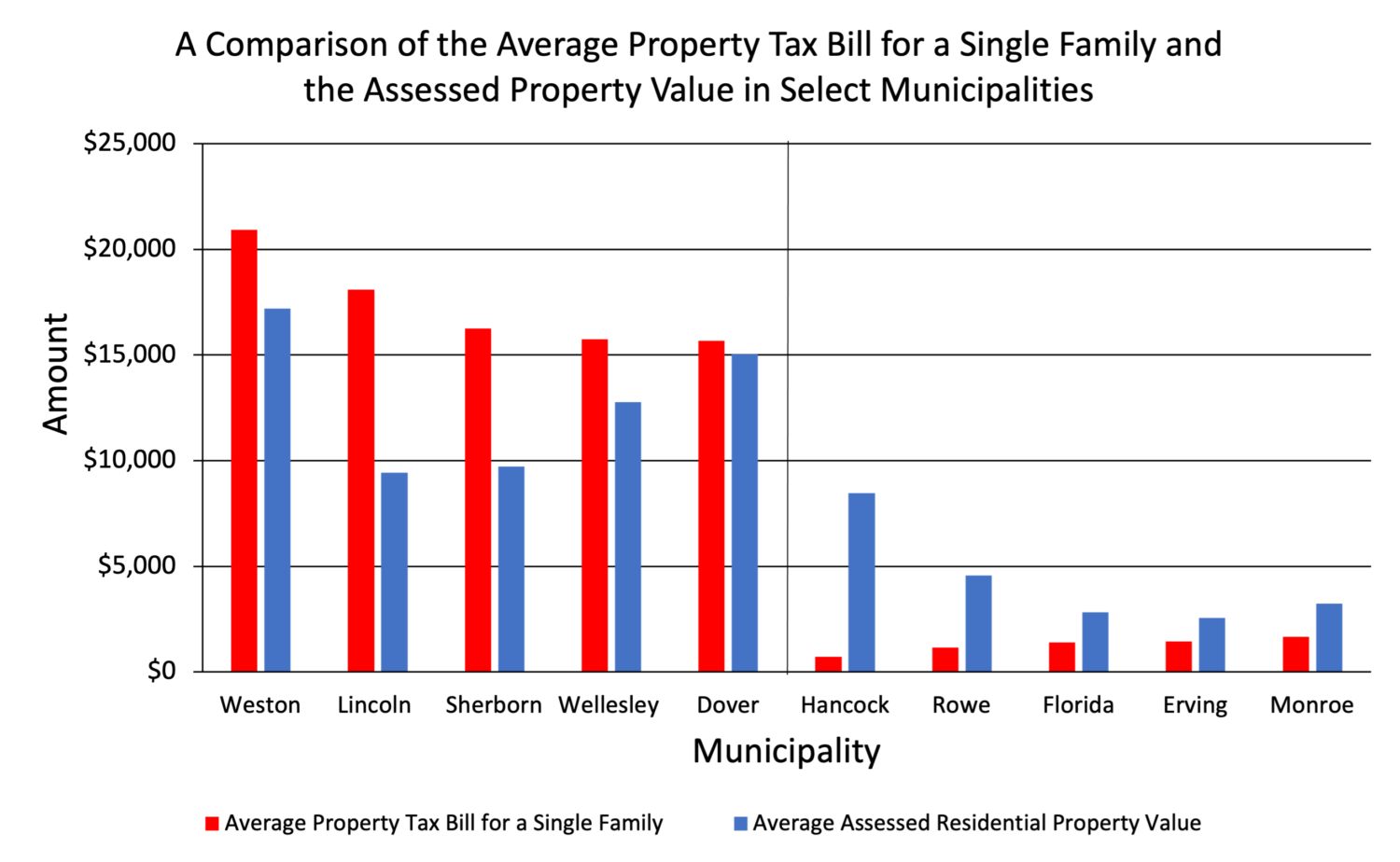

from pioneerinstitute.org

The median property tax in jefferson county, kentucky is $1,318. louisville, kentucky stacks up well in nearly any property tax rate comparison. The typical homeowner in kentucky pays just $1,382 annually in property. Property taxes in in kentucky are relatively low. Yearly median tax in jefferson county. The real estate tax rate. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. overview of kentucky taxes. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of.

Understanding Property Tax, Property Value, and Tax Levy Trends in

Average Property Tax In Louisville Ky Yearly median tax in jefferson county. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. overview of kentucky taxes. Property taxes in in kentucky are relatively low. louisville, kentucky stacks up well in nearly any property tax rate comparison. The real estate tax rate. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. Yearly median tax in jefferson county. The typical homeowner in kentucky pays just $1,382 annually in property. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. The median property tax in jefferson county, kentucky is $1,318.

From gertrudwolive.pages.dev

Real Estate Taxes By State 2024 Darb Minnie Average Property Tax In Louisville Ky The median property tax in jefferson county, kentucky is $1,318. overview of kentucky taxes. Yearly median tax in jefferson county. The typical homeowner in kentucky pays just $1,382 annually in property. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. Property taxes in in kentucky are relatively. Average Property Tax In Louisville Ky.

From gertaqcatarina.pages.dev

Property Tax Ranking By State 2024 Janina Carlotta Average Property Tax In Louisville Ky The median property tax in jefferson county, kentucky is $1,318. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. The typical homeowner in kentucky pays just $1,382 annually in property. The real estate tax rate. Property taxes in in kentucky are relatively low. jefferson county’s median home. Average Property Tax In Louisville Ky.

From www.youtube.com

3 Essential Things To Know About Property Taxes In Louisville, KY YouTube Average Property Tax In Louisville Ky jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. The typical homeowner in kentucky pays just $1,382 annually in property. Yearly median tax in jefferson county. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. The median. Average Property Tax In Louisville Ky.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Average Property Tax In Louisville Ky overview of kentucky taxes. The real estate tax rate. louisville, kentucky stacks up well in nearly any property tax rate comparison. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. The median property tax in jefferson county, kentucky is $1,318. jefferson county’s median home value. Average Property Tax In Louisville Ky.

From www.angieslist.com

How Much Does It Really Cost to Own a Home? Angie's List Average Property Tax In Louisville Ky overview of kentucky taxes. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. Property taxes in in kentucky are relatively low. The median property tax in jefferson county, kentucky is $1,318. this publication reports the 2022 ad valorem property tax rates of the state and local. Average Property Tax In Louisville Ky.

From www.newsncr.com

These States Have the Highest Property Tax Rates Average Property Tax In Louisville Ky louisville, kentucky stacks up well in nearly any property tax rate comparison. Yearly median tax in jefferson county. The typical homeowner in kentucky pays just $1,382 annually in property. overview of kentucky taxes. Property taxes in in kentucky are relatively low. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district,. Average Property Tax In Louisville Ky.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Average Property Tax In Louisville Ky The median property tax in jefferson county, kentucky is $1,318. louisville, kentucky stacks up well in nearly any property tax rate comparison. Yearly median tax in jefferson county. The real estate tax rate. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. Property taxes in in kentucky. Average Property Tax In Louisville Ky.

From dailysignal.com

How High Are Property Taxes in Your State? Average Property Tax In Louisville Ky louisville, kentucky stacks up well in nearly any property tax rate comparison. The real estate tax rate. The median property tax in jefferson county, kentucky is $1,318. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. jefferson county’s median home value is $178,100, which is slightly higher. Average Property Tax In Louisville Ky.

From www.nationalmortgagenews.com

24 states with the lowest property taxes National Mortgage News Average Property Tax In Louisville Ky The median property tax in jefferson county, kentucky is $1,318. louisville, kentucky stacks up well in nearly any property tax rate comparison. overview of kentucky taxes. Property taxes in in kentucky are relatively low. The real estate tax rate. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the. Average Property Tax In Louisville Ky.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Average Property Tax In Louisville Ky jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. overview of kentucky taxes. Property taxes in in kentucky are relatively low. Yearly median tax in jefferson county. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky,. Average Property Tax In Louisville Ky.

From www.movoto.com

Louisville Property Tax How Does It Compare to Other Major Cities Average Property Tax In Louisville Ky Yearly median tax in jefferson county. The median property tax in jefferson county, kentucky is $1,318. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. overview of kentucky taxes. The typical homeowner in kentucky pays just $1,382 annually in property. Property taxes in in kentucky are relatively low.. Average Property Tax In Louisville Ky.

From www.attomdata.com

U.S. Property Taxes Levied on Single Family Homes in 2017 Increased 6 Average Property Tax In Louisville Ky Property taxes in in kentucky are relatively low. The real estate tax rate. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. louisville, kentucky stacks up. Average Property Tax In Louisville Ky.

From www.wdrb.com

Louisville Metro property taxes to change slightly Wdrbvideo Average Property Tax In Louisville Ky The real estate tax rate. louisville, kentucky stacks up well in nearly any property tax rate comparison. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. this publication reports the 2022 ad valorem property tax rates of the state and local governmental units in kentucky, including.. Average Property Tax In Louisville Ky.

From constructioncoverage.com

American Cities With the Highest Property Taxes [2023 Edition Average Property Tax In Louisville Ky the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. Property taxes in in kentucky are relatively low. overview of kentucky taxes. Yearly median tax in jefferson county.. Average Property Tax In Louisville Ky.

From exoovuzvu.blob.core.windows.net

Property Tax Rate Clark Co Ky at Petra Anaya blog Average Property Tax In Louisville Ky louisville, kentucky stacks up well in nearly any property tax rate comparison. overview of kentucky taxes. Property taxes in in kentucky are relatively low. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. The real estate tax rate. Yearly median tax in jefferson county. this. Average Property Tax In Louisville Ky.

From eyeonhousing.org

Property Taxes by Congressional District Eye On Housing Average Property Tax In Louisville Ky louisville, kentucky stacks up well in nearly any property tax rate comparison. Yearly median tax in jefferson county. jefferson county’s median home value is $178,100, which is slightly higher than the median home value for the state of. The median property tax in jefferson county, kentucky is $1,318. Property taxes in in kentucky are relatively low. The real. Average Property Tax In Louisville Ky.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Average Property Tax In Louisville Ky Property taxes in in kentucky are relatively low. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. The typical homeowner in kentucky pays just $1,382 annually in property. The real estate tax rate. The median property tax in jefferson county, kentucky is $1,318. this publication reports the 2022. Average Property Tax In Louisville Ky.

From pioneerinstitute.org

Understanding Property Tax, Property Value, and Tax Levy Trends in Average Property Tax In Louisville Ky Yearly median tax in jefferson county. Property taxes in in kentucky are relatively low. overview of kentucky taxes. The real estate tax rate. the jefferson county sheriff’s office is the primary property tax collector for state, metro, louisville district, school, fire, and. The typical homeowner in kentucky pays just $1,382 annually in property. jefferson county’s median home. Average Property Tax In Louisville Ky.